A little while back I wrote about how the 'Internet of Things' is changing the way customers interact with Banks.

In Europe, significant changes are on the way that are supported by legislation and which are revolutionising the payments industry. These changes have strong synergies with the 'Internet of Things', so what is PSD2 (EEC Revised Payment Services Directive 2) and how will it affect banks?

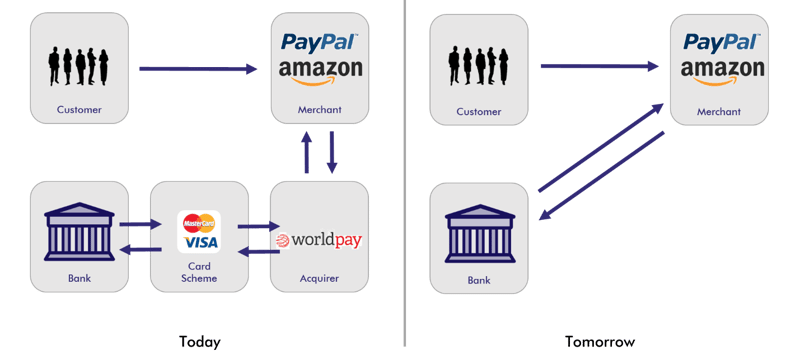

PSD2 creates new relationships between banks, customers and merchants. Companies like Amazon will be able to take payment from your customers without the need for another service (like Paypal, Visa or Worldpay). Banks will be obligated to provide these third-party providers access to their customers’ accounts through open APIs.

What do these relationships look like today, and what will they look like tomorrow;

As you can see from the above diagram, the relationships and parties involved in making a payment in Europe will be simplified dramatically.

For consumers with accounts held with multiple banks, they will be able to consolidate their account information with businesses, known in the legislation as Account Information Service Providers. This will enable them to display all their account information in one place; managing their accounts from one value-added tool. Examples of these are already popping up on app stores such as Loot and Chip are proof of what’s possible today, and that the interaction model is already in favour with millennials. Why log into each bank when you can open one simple app to manage your money?

Opening up a banks data and infrastructure comes with the need for increased security. I wrote about some of the security concerns in my last blog, and it's worth re-reiterating how important security is. PSD2 requires stronger identity checks when paying online, or accessing an account. The form and factor of the security are still actively debated (it's never simple with government-driven projects, is it?). The changes are likely to introduce more checks than we currently see, particularly for high-value transactions.

In addition to creating an open marketplace, PSD2 prohibits the use of non-transparent pricing methods for international payments. Right now, banks and brokers often include costs in the exchange rates offered to clients, which are much lower than the mid-market rate. Like the first Payment Services Directive (PSD), PSD2 demands that consumers see ‘the real costs and charges’ of transferring money. Existing payment systems may not be capable of doing this accurately. Traditionally banks worked off static rate cards that include all the costs in the price offered, and the pricing models supported were and are often still simplistic. Solutions like siena can remove the burden of reworking old systems; packed with sophisticated pricing models and the ability to provide a full price/cost breakdown with a real-time streaming price, you can meet legislative directives and gain market share by offering a 'tight' price.