On 12th December the British electorate will head to the polls for the third time in four years. Each political party is asking the public to put their faith in its manifesto and to fund a splurge in public spending after years of austerity. This has sparked a broader topic of discussion in relation to (i) the extent to which the opportunity to cast our vote represents a chance to hold the conduct of our politicians to account, (ii) assess the policies of the incumbent party during the previous parliamentary period, and (iii) whether there are more efficient (and frequent) ways of making politicians accountable.

Meanwhile, today the Senior Managers Certification Regime (SMCR) comes into effect for solo-regulated firms in the financial sector.

The key impetus behind this regulatory change being to strengthen market integrity via raising the standards of conduct for everyone who works in financial services In turn, this makes senior people in these firms more responsible and accountable for their conduct, actions and competence. The forthcoming SMCR will impact around 47,000 companies.

Before delving into the broader ranging implications of what this means in practice for the firms in scope, let’s first revisit the main aspects of SMCR’s regulatory framework.

SMCR was introduced in March 2016 for banks, building societies and PRA designated investment firms. It was following the financial crisis of 2007-8 against a backdrop of rogue trading and Libor rate-fixing scandals in the financial industry. Senior directors and heads of trading desks claimed to have no knowledge of these scandals (and largely escaped culpability in relation to) the dubious trading activities of their subordinates, whilst simultaneously encouraging a culture of short-term profit making at any cost. Like many financial meltdowns of previous eras; wrongdoing was followed by a period of regulatory enforcement, a kind of reactionary antidote to try and prevent a repeat of the ills of the past. SMCR is no different, and was introduced to increase accountability, especially of senior personnel, across the financial services industry.

Core to the SMCR are the three main elements summarised below:

- Senior Managers Regime. A newly created senior management regime whereby those identified as senior managers are to have been allocated clear individual responsibilities, for which they will be personally accountable. These will include the conduct of employees who serve under their leadership. The most senior members of an organisation will require approval from the FCA, with firms also having a responsibility to ensure they are ‘fit and proper’. To achieve this, each senior manager is required to have a “statement of responsibilities” mapping precisely what and whom they are responsible and accountable for within the firm. In addition, the statements of responsibility for the senior members of a firm must between them contain details as to which individual is directly responsible for certain “Prescribed Responsibilities” specified by the FCA.

- Certification Regime. This covers employees who do not fall under the senior managers regime but where their role could have a significant impact on customers, the firm or market integrity. Examples would be proprietary traders, sales personnel, or those individuals who are able to take on material risk as part of their job function. Although these employees are not required to be approved by the FCA, they are required to be certified annually by the firm to ensure they remain “fit and proper”.

- Conduct Rules. These rules apply to virtually all staff working within ‘in scope firms’ and enforce new behavioural conduct rules outlined below. This represents the first time in which staff members have a direct duty of conduct (and accountability) to the FCA and breaches by a staff member of such duties are required to be reported to the FCA. Staff must:

- act with integrity;

- work with due care and diligence;

- be open and cooperative with the FCA, PRA, and other regulators;

- pay due regard to the interest of customers/clients and treat them equitably; and

- observe standards relating to market conduct.

Senior Managers are also subject to additional conduct rules relating to responsibility for the delegation of their workflow in addition to the more general conduct rules referred to above.

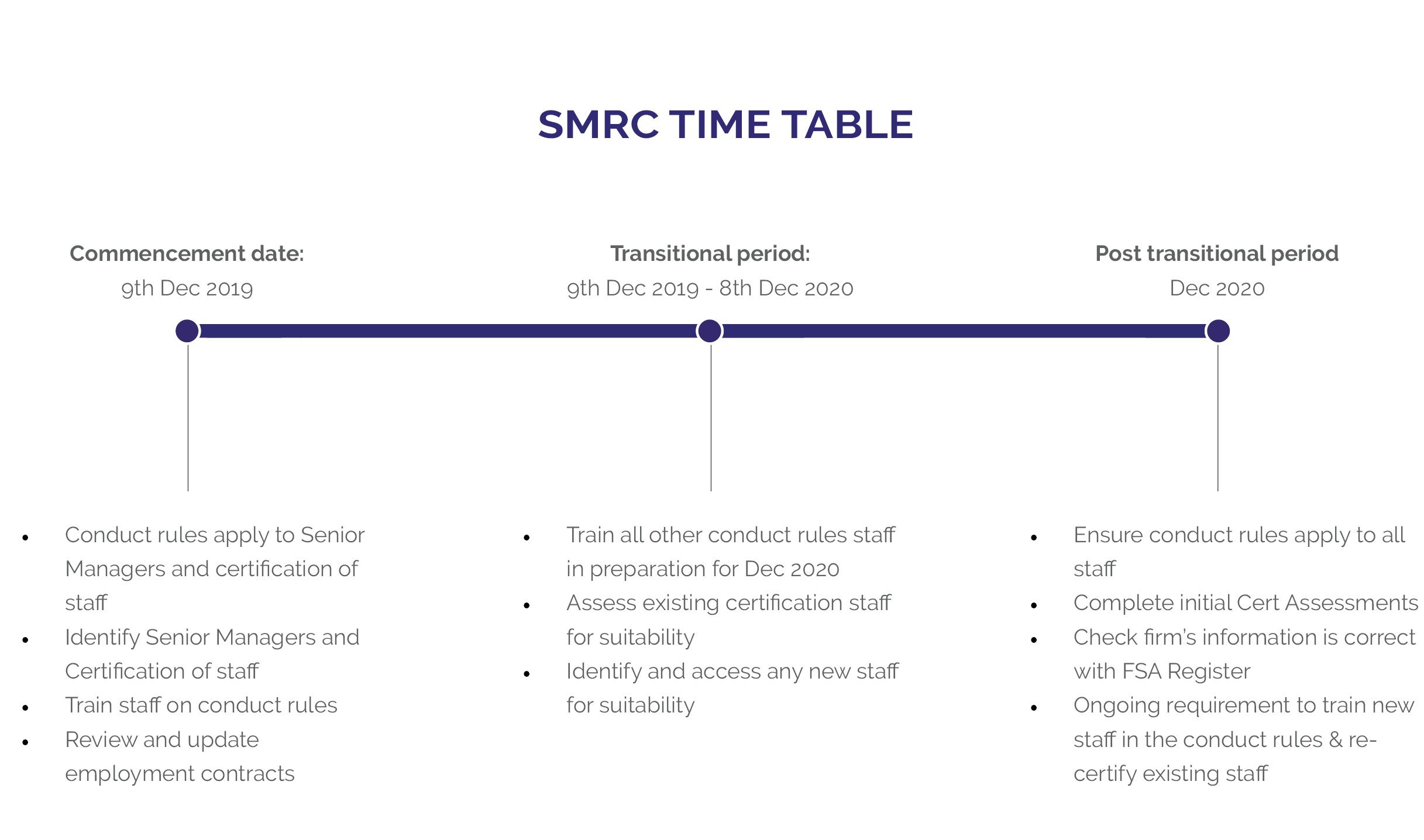

The diagram below illustrates the timeline for compliance with SMCR:

So, what are the wider implications of the SMCR for firms and individuals within the financial services industry? As it did in the banking world, the roll-out of the SMCR is likely to have a substantial impact on the market and firms in scope, including the employer/employee relationship and HR processes of such firms. Material changes to the risks of those individuals working in the most senior roles, annual “fit and proper” appraisals for certified staff and the imposition of a new code of conduct for all staff with direct recourse to the FCA in the event of breach arguably represents a substantial change to firms and individuals alike.

On cultural reform, it is expected there will be a significant change in tone and ownership from Senior Managers, with an increase in clarity of thought around cultural expectations within the relevant firm.

What would it be like if such an accountability regime was implemented in the world of politics, I wonder?