Man-made disasters, NAT-CAT, Reinsurance, ILS and Collateralised Reinsurance – how does all of this fit together?

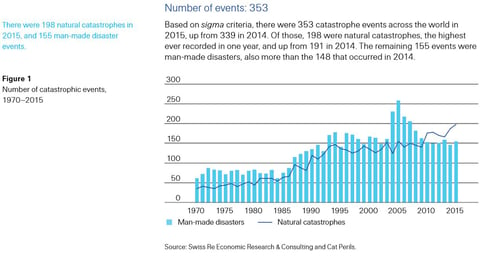

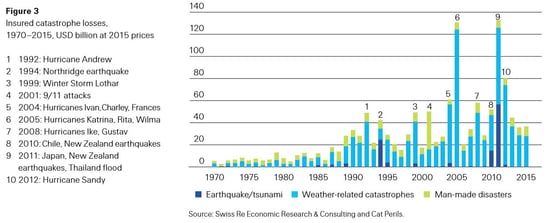

There is no denying a constantly increasing trend of man-made disasters and NAT-CAT events both in frequency and severity. This can be seen in the charts taken from Swiss Re’s SIGMA 01/2016 publication for the year end 2015.

The year 2016 is not likely to change that pattern. Having already had wildfires in Alberta, Canada, - which started on May 3rd 2016 and was by the 13th of June 2016 only 82% contained - insured losses for this event alone are now estimated to be in the region of USD 3.52bn. Followed by another wildfire in California near Los Angeles which is still ongoing, floods in Australia, New Zealand, Africa, Brazil, Asia, the USA, Continental Europe and the UK; earthquakes in Asia and severe weather in the USA, the past 6 months have been unpredictable, to say the least. 2016 has also had its fair share of man-made disasters. There have been hundreds of terror incidents in the more politically unstable areas including France, Brussels and most recently, last month in the Orlando night club shooting and in Turkey. On top of all of this, it looks likely that the next 6 months will be no different, with more bad weather set to come. The Weather Company has predicted ‘the most active hurricane season since 2012’ caused by the warming of the North Atlantic, according to Artemis.

Surprisingly, this doesn’t seem to have had much impact on the reinsurance premium rates. So far, rates for 2016 have remained soft. One element of impact is, as Andrew Newman, President of reinsurance broker Willis Re, told ratings agency A.M. Best at the 2016 Meeting of Reinsurance Officials, that the reinsurance sector is “probably at an inflection point,” following ten years of “wonderful results.” Aided by benign catastrophe loss years and reserve releases, reinsurers are generally continuing to report sound ROEs (return on equity) and combined ratios in testing market times, a trend which is unlikely to continue.

Another element of impact is simply availability of capital by investors, as well as a tendency for ILS to evolve more into collateralised reinsurance models. Traditional ILS has the restrictions of having higher marketing costs than reinsurance and also is seen as less accessible by the more traditional cedents of risks.

According to Artemis, Collateralised Reinsurance (CRI) is referred to a reinsurance contract or program which is fully-collateralised (minus the premiums), typically by investors such as hedge funds, pension funds or third-party capital. The market in CRI enables these investors to directly participate in the reinsurance market and provide a source of risk capital to cedents in the market. This risk capital is increasingly popular as it helps a cedent diversify its sources of reinsurance protection due to the fully-collateralised nature of the reinsurance vehicle.

CRI are typically more customisable and less liquid investments than catastrophe bonds. CRI are often created by taking reinsurance contracts and transforming them using an offshore entity into securities which are bought and so collateralised. This side of the market is growing and allows investors to access a much broader class of insurance risk should they choose to do so. Furthermore there are first attempts to include medium tail risk into the portfolio of possible coverages.

As these vehicles become more and more attractive and are more commonly used, it appears that traditional reinsurance and ILS are growing closer to take advantage of capital available to cover specific risks. This makes it even more important to ensure there is a means to manage all the surrounding data. Data which includes investors, funds, vehicle information as well as associated financial transactions in a way to satisfy the growing regulatory and legal demands. As collateralised reinsurance is likely to stay, it becomes increasingly important to manage traditional reinsurance and ILS/collateralised reinsurance data in a way allowing reporting on the combined data.

There is no denying a constantly increasing trend of man-made disasters and NAT-CAT events both in frequency and severity. This can be seen in the charts taken from Swiss Re’s SIGMA011/2016 publication for the year end 2015.