Given the longstanding focus on the familiar, well-used trading benchmarks and indices currently in use but due to be retired or changed, it’s quite normal to feel that you don't know your SARON from your €STR!

Many of us have cheat sheets on our desktops to keep track of which benchmark has replaced which. I hope this blog goes some way to clarify what each new acronym is. Each of these benchmarks has its purpose, currency and name. In the past, the interbank borrowing rates, such as Libor, comprised of benchmarks for several currencies. In general, the new benchmarks are either nearly Risk Free Rates (RFRs) with an overnight tenor or more like for like Libor replacements.

The Libor rates that are due to be phased out at the end of next year are those for the USD, EUR, GBP, JPY, and CHF. The Libor rates for AUD, CAD, NZD, DKK and SEK were discontinued in the Libor reforms of 2013.

Over the last year or so my cheat sheet has grown. Below are a few notes of clarification on the new benchmarks, and how they are constructed.

SONIA – The United Kingdom

The U.K.'s Libor replacement, the Sterling Overnight Index Average is in-fact an existing index that was relaunched in 2018. Like €STR, SONIA measures the rate paid on unsecured overnight funds. The reformed benchmark includes transactions negotiated bilaterally between banks as well as broker-intermediated loans. U.K. regulators are developing a SONIA term rate. In parallel, the regulator is pushing lenders and borrowers to amend existing Libor-based contracts as part of its transition programme.

SOFR/AMERIBOR – The United States

The Secured Overnight Financing Rate is set to replace USD Libor, that underpins trillions of dollars' worth of securities. SOFR is based on real transactions, not just bank quotes; it provides only an overnight rate. SOFR is the preferred choice of the Federal Reserve’s Alternative Reference Rates Committee (ARRC) and the large dealing banks. However, many corporates and other participants favour AMERIBOR which is based on overnight unsecured loans transacted on the American Financial Exchange, LLC (“AFX”).

€STR/EURIBOR - Europe

The Euro Short-Term Rate, €STR or ESTR is set to replace EONIA. €STR draws on money-market transactions that show the overnight unsecured borrowing costs of euro-area lenders. The EURIBOR benchmark that is similar to the old EUR Libor rate is not set to be discontinued and the reformed (January 2020 onwards) EURIBOR is still used.

SARON - Switzerland

The Swiss have turned to SARON a benchmark born sometime before the Libor rigging scandal occurred. SARON, the Swiss Average Rate Overnight, like SOFR, is based on overnight trades, but in this case, it's the CHF repurchase agreement market. SARON is explicitly based on transactions between financial institutions.

SORA - Singapore

The new Singapore Overnight Rate Average SORA is based on an average rate of unsecured overnight interbank onshore SGD transactions. Its predecessor Singapore Swap Offer Rate known as SOR is computed from borrowing USD and swapping them into the local currency.

TIBOR & TONAR - Japan

The Japanese Central Bank is leaning on two alternatives to yen Libor; TIBOR and TONAR.

TIBOR, the Tokyo Interbank Offered Rate, is the JPY version of Libor. The Japanese Bankers Association Tibor Administration had already reformed in 2017 by introducing a new methodology that relies on actual transaction data.

TONAR, the Tokyo Overnight Average Rate is the Japanese's short-term alternative based on transactions in the uncollateralized overnight borrowing market.

Like the U.K. regulator, the Japanese Regulators are seeking to develop a term structure. This structure would be based on market data for overnight index swaps, using TONAR as the floating leg.

HONIA – Hong Kong

The Hong Kong Dollar Overnight Index Average, known as HONIA, is the alternative benchmark proposed to operate in parallel with the Hong Kong Interbank Offered Rate, known as Hibor.

HONIA is based on unsecured lending transactions in the interbank market. At present plans are to adopt a multi-rate approach where Honia and Hibor exist in tandem.

BBSW & AONIA – Australia

Like Japan, the Australian regulator has two benchmarks.

BBSW, the Bank Bill Swap Rate, is referenced in about A$18 trillion ($13 trillion) of transactions. Unlike the AUD Libor rate, BBSW is based on actual transactions in the bank bill market.

AONIA, the Australian Over-Night Index Average is gaining traction. AONIA is based on the rate at which unsecured funds are lent in the domestic interbank market.

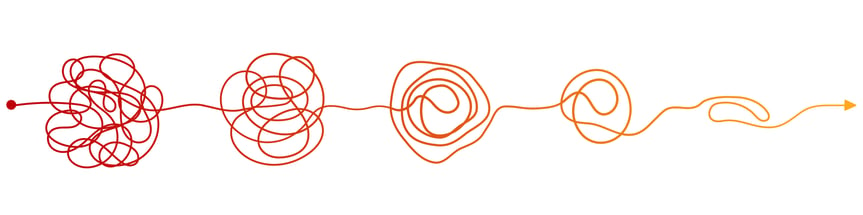

Adapting with Agility

In an ever more quickly changing world, we should be prepared to implement new benchmarks and indices with great agility. Rather than hard-wiring calculations, observation periods, and such like into our systems, we should look to solutions that allow a greater degree of configuration for each index/benchmark. As platform vendors, our solutions will allow for fast implementation of any new benchmark the markets dictate.